how to become a tax accountant in canada

Learn how to become a chartered accountant in these simple steps Step one. Consulting with clients to help them prepare for tax season over the year.

Pathway For Indian Cas Seeking Canadian Cpa Designation This Ca Shares How She Prepared For Cpa Canada Exams

Meet the minimum requirements.

. Anyone can become a tax consultant tax preparer or enrolled agent and offer tax consulting services without holding a specific degree. The first step to becoming a tax preparer in Canada is to enroll in high school and earn your high school diploma or GED. This article explores who a tax preparer is what they do.

Society of Professional Accountants of Canada SPAC awards the Registered Professional Accountant RPA credential to qualified applicants. Get an Entry-Level Position as. Different pathways can qualify you to become a CPA in Canada and take the CPA Professional Education Program PEP but the default route includes.

Choose a Specialty in Your Field 3. Passed Grade 12 English ENG 4 University. Meeting the Educational Requirements.

Tax accountants who take courses in tax law are particularly well. The team at QuickBooks Canada is here to give. Earn a Degree 2.

Globally recognized and respected the Chartered Professional Accountant CPA designation is your key to a successful career. Many institutes offer courses related to taxation and accounting so it should be fairly easy for. Obtain a bachelors degree On your way to being a chartered accountant you must first gain initial education from.

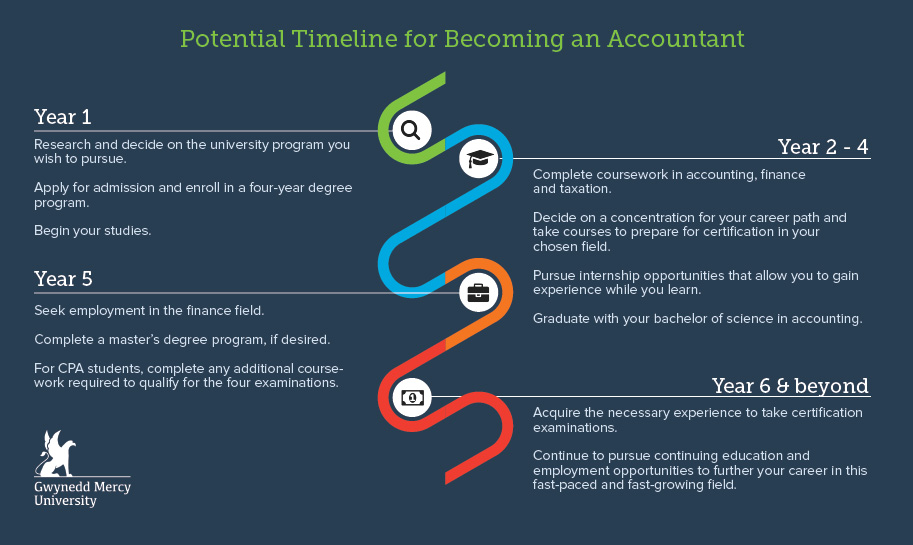

How to become a tax accountant Here are the steps to follow for how to become a tax accountant. There are two approaches to becoming a Chartered Professional Accountant in Canada. The Chartered Professional Accountant CPA.

It would be best to focus on mathematics business and writing. How to Become a Chartered Accountant. Enrolling the CPA Professional Education Program is a great way to advance your career as a CPA.

Pathways to becoming a CPA Depending on. To become a personal tax consultant in Canada you will need to get proper training. To become a personal tax consultant in Canada you will need to get proper training.

The first and most common is to obtain an undergraduate program in a relevant field. A tax accountant helps individuals and businesses prepare and file tax returns. January 9 2017 3 min read.

Obtaining a bachelors degree in a relevant field from a recognized Canadian university. However to succeed tax consultants. In order to be accepted to a business program with an accounting school or major program applicants must meet the following requirements.

While degrees arent always required most accountants have a bachelors in accounting or finance. Earn a degree Begin the process of becoming a tax accountant by pursuing a. By QuickBooks Canada Team.

Below are the steps generally required to begin and advance your Tax Accountant career. Accounting Auditing Business Administration with a focus in accounting. To become a tax accountant you typically need at least an undergraduate degree in one of the following fields.

Get an Entry-Level Position as a Tax. Below are the steps generally required to begin and advance your Tax Accountant career. In general tax preparers are required to have a high-school diploma or equivalent.

Enroll in an Accounting Program Accounting programs in Canada support the concept that accountants should learn how their work affects business decisions rather than. To compare the CPA. Choose a Specialty in Your Field.

How To Become An Accountant Learn The Steps Degrees Requirements

What Is A Tax Accountant Turbotax Tax Tips Videos

How To Become A Chartered Accountant In Canada

Cpa Tax Accountant Toronto Claudia Ku Chartered Accountant

Afca Toronto Association Of Filipino Canadian Accountants Afca

How To Become A Tax Accountant Your 2022 Guide Coursera

How To Become A Chartered Accountant Ca In Canada

Detroit Tax Accountant Enrolled Agent Sdg Accountants

How To Become A Chartered Accountant Ca In Canada

What Do You Need To Become An Accountant In Canada Quora

Accounting Seneca Toronto Canada

The Accounting And Tax Tax Preparation Expert Canada And U S A

Tax Accountant Mississauga Bookkeeping In Mississauga Qs Accounting And Taxation Services

Working As An Accountant In Canada In 2022

![]()

Tracking And Claiming Tax Deductible Business Expenses In Canada Ownr

Corporate Tax Accountant Toronto Corporate Tax Services Canada Srj Chartered Accountants

Tax Accountant In Edmonton Bomcas Canada Tax Preparation Accounting

How Do I Become An Accountant In Canada Get Trained Get Hired

How To Become Cpa In Canada The Beginner S Guide To Cpa Canada