maine excise tax rate

The excise tax due will be 61080. B 9 NEW B.

A Voice For The Industry Water Well Journal

Motor Vehicle Excise Taxes.

. 2019 -- 1000 per 1000 of value. July 1 - June 30. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

For all other watercraft the tax payable shall be reduced. Contact 207283-3303 with any questions regarding the excise tax calculator. The excise tax you pay goes to the construction and.

The amount of tax you pay depends on two things. Taxes on retail marijuana and retail marijuana products. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land.

Tax Return Forms. 2020 -- 1350 per 1000 of value. For any commercial vessel the tax payable shall be 50 of the value due under subsection 1.

Chapter 213 Sales Tax. 13 rows Maine Tax Portal. Mil rate is the rate used to calculate excise tax.

Commercial Forestry Excise Tax. As of August 2014 mil rates are as follows. Departments Treasury Motor Vehicles Excise Tax Calculator.

YEAR 1 0240 mil rate YEAR 2 0175. The age of the vehicle 2. Property Tax Educational Programs.

2022 -- 2400 per 1000 of value. 2021 -- 1750 per 1000 of value. Tax on adult use marijuana and adult use marijuana products.

July 1 - June 30. Interest Rates 1992 to Present. Excise Tax is calculated by multiplying the.

The excise tax you pay goes to the construction and. Tax Rate Per 1000 2000 mils. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

March 2023 Certified Maine Assessor. Property Tax Stabilization Program. Mil rate is the rate used to calculate excise tax.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. HOW MUCH IS THE EXCISE TAX. To calculate your estimated registration.

Excise Tax is an annual tax that must be paid. This calculator is for the renewal registrations of passenger vehicles only. Property Tax Law Changes 2022.

Visit the Maine Revenue Service page for updated mil rates. 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100 cubic feet. The rates drop back on January 1st each year.

2018 -- 650 per. MSRP manufacturers suggested retail price HOW IS THE EXCISE TAX. Share this Page How much will it cost to renew my registration.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. 2721 - 2726. Designed to provide the public with answers to some of the.

Calculation will be based on. The rates drop back on January 1st each year. Welcome to Maine FastFile.

How much will it cost to renew my.

Where Did Maine Rank In The List Of 10 Least Tax Friendly States

Augusta Councilors Approve Tax Break For 250 Unit Housing Development Centralmaine Com

Maine Sales Tax Calculator And Local Rates 2021 Wise

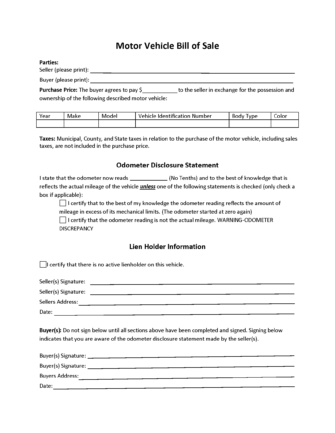

Free Maine Motor Vehicle Bill Of Sale Form Pdf Word

Maine Sales Tax Small Business Guide Truic

Tax Maps And Valuation Listings Maine Revenue Services

Why Maine License Plates Jam Out Of State Highways Portland Press Herald

Free Maine Motor Vehicle Bill Of Sale Form Pdf

Maine Income Tax Calculator Smartasset

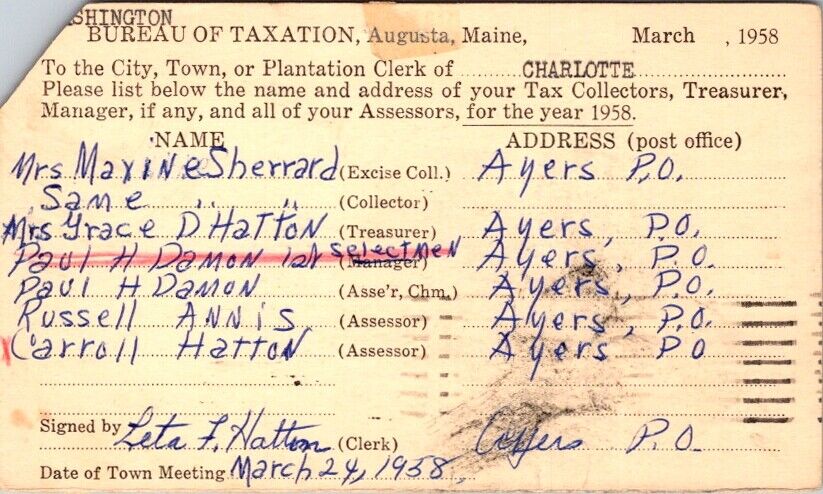

Postal Card State Of Maine Bureau Of Taxation To Charlotte Maine Me 1958 S348 Ebay

Maine Car Registration A Helpful Illustrative Guide

Tax Friendly States And Cities Jan 28 2002

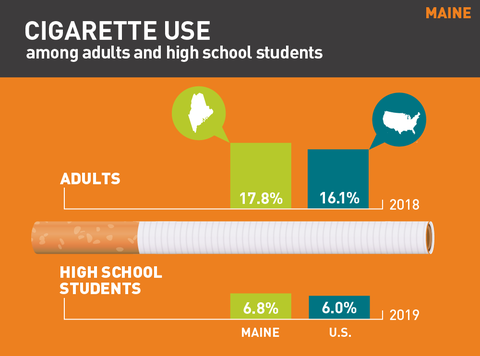

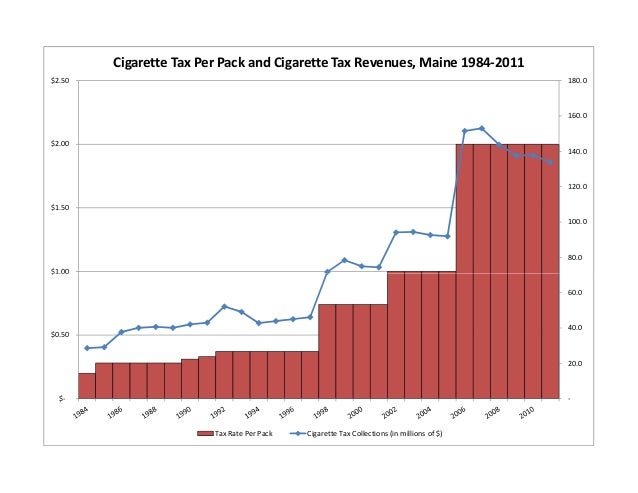

Chart Cigarette Excise Tax Vs Tax Rate 1998 2011

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

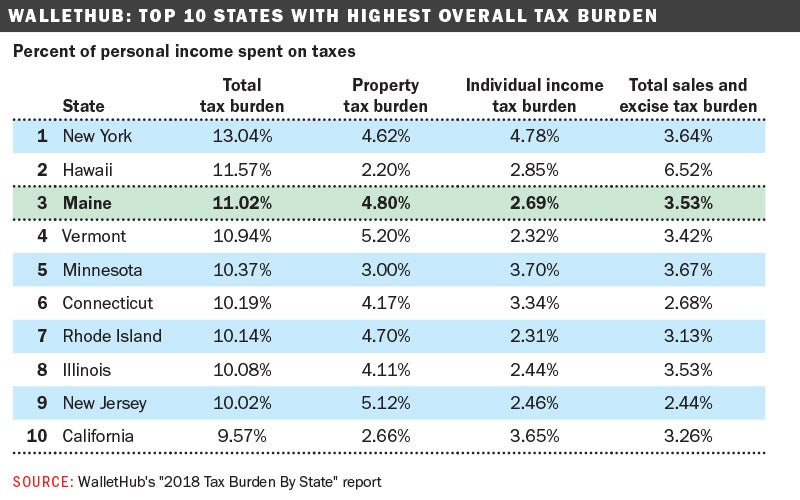

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact